Australia

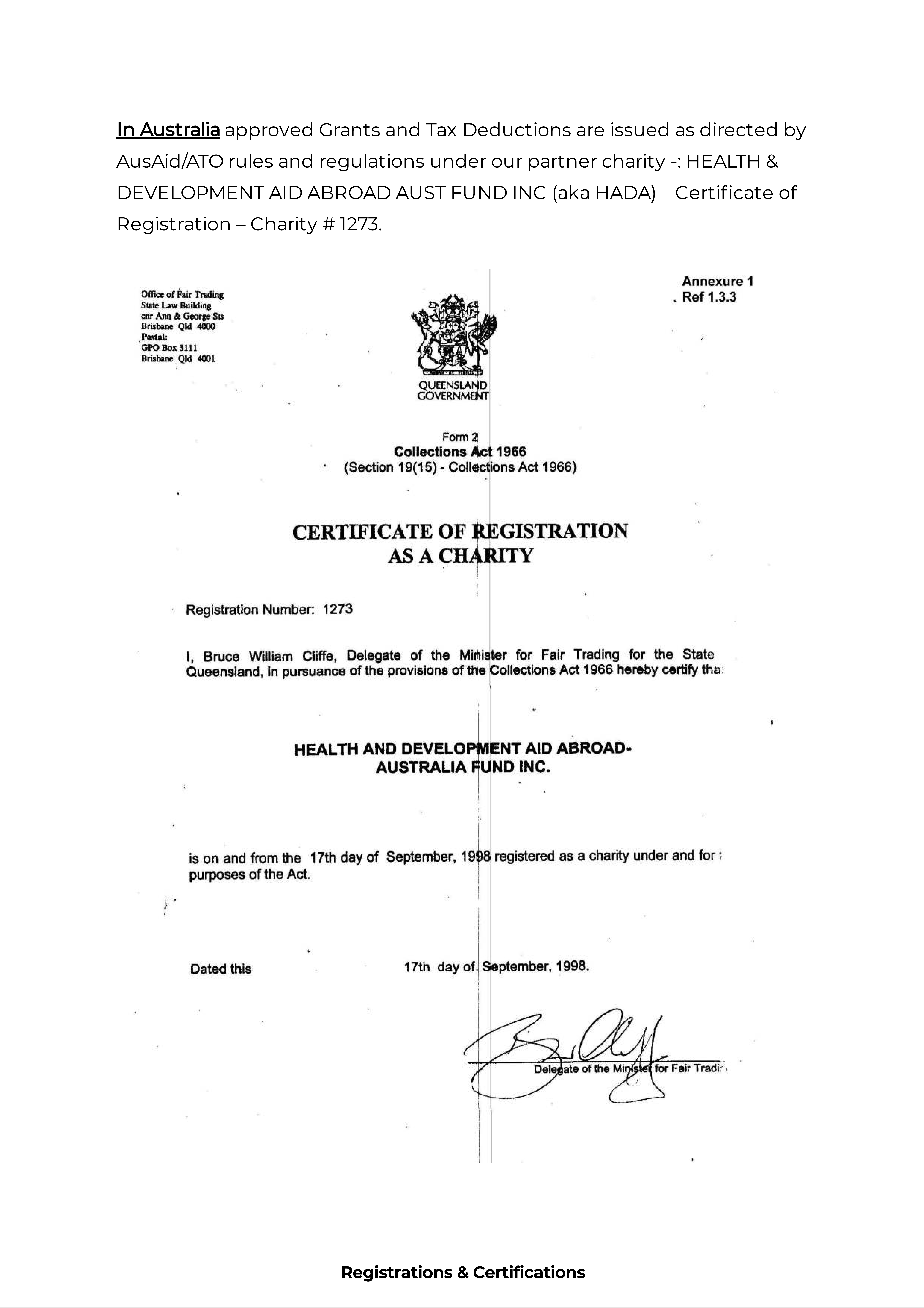

In Australia, Tax Deductible Donations receipts via our partner HADA (Health & Development Aid Abroad Australia Fund Inc.) under the regulations of AusAid and the Australian Government. Donations via HADA are Tax Deductions.

Summary Audit letters: 2017 | 2018 | 2019 | 2020

Full Financials can be viewed on the Australian Charities and Not for Profits Commissions website.

United Kingdom

In the United Kingdom, on the 24 November 2017 we received from The Charity Commission for England and Wales our Registered Charity Number 1175916, while on 19 January 2018 we received our Gift Aid reference #EW86484.

Gift Aid allows individuals who are subject to UK income tax to complete a simple, short declaration that they are a UK taxpayer. Any cash donations that the taxpayer makes to the charity after making a declaration are treated as being made after deduction of income tax at the basic rate (20% in 2011), and the charity can reclaim the basic rate income tax paid on the gift from HMRC.

For a basic-rate taxpayer, this adds approximately 25% to the value of any gift made under Gift Aid. Higher-rate taxpayers can claim income tax relief, above and beyond the amount claimed directly by the charities. The rate of the relief for higher-rate taxpayers in 2011 is usually 20%, the difference between the basic rate (20%) and the higher rate (40%) of income tax, although recipients of dividend income (taxed at 10% and 32.5%) can achieve a higher rate of tax relief (22.5%).

Summary Audit letters: Not applicable to date.

European Union

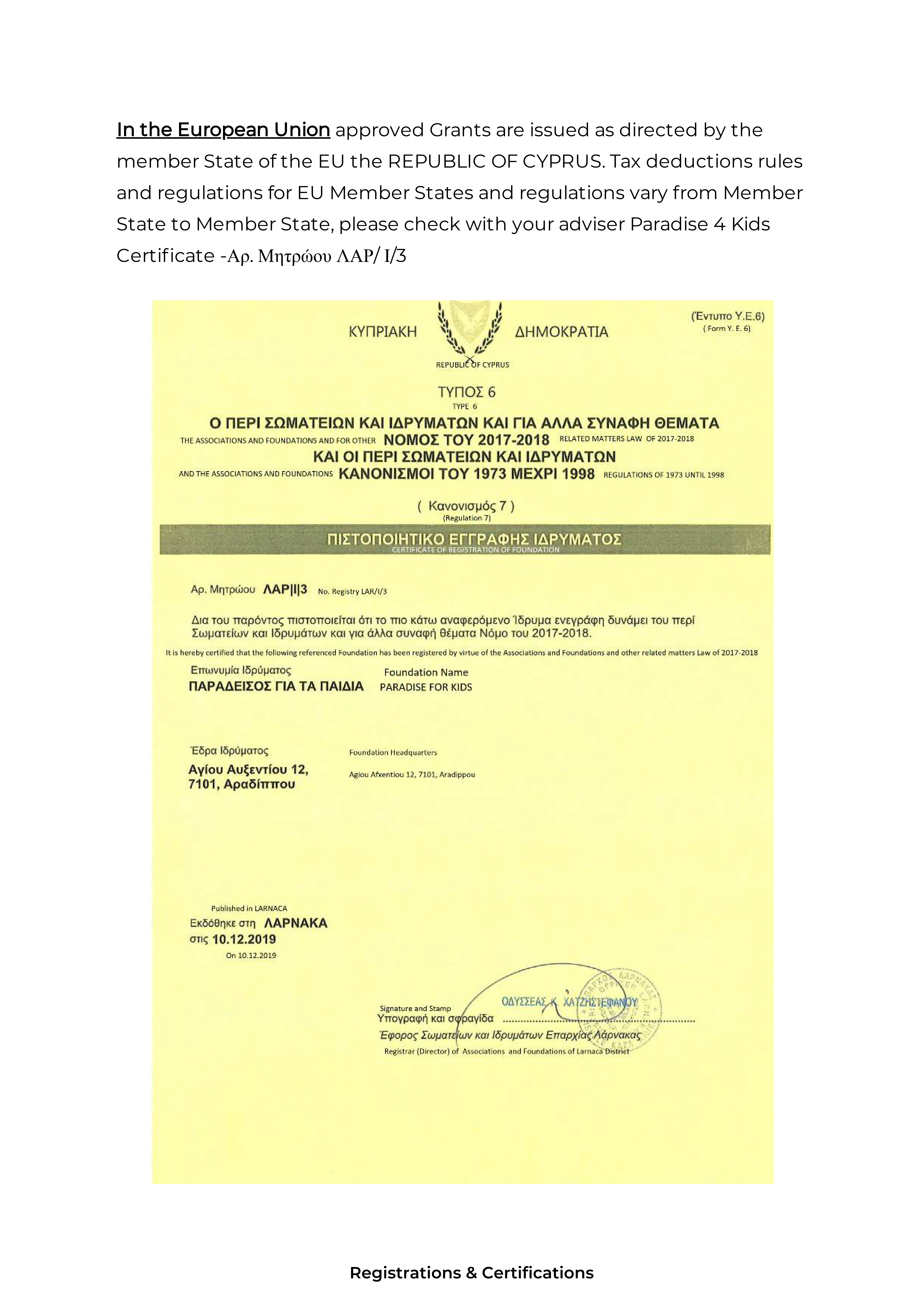

In the European Union approved Grants are issued as directed by the member State of the EU and the REPUBLIC OF CYPRUS. Tax deductions rules and regulations for EU Member States and regulations vary from Member State to Member State, please check with your adviser Paradise 4 Kids Certificate – Αρ. Μητρώου ΛΑΡ/I/3

Summary Audit letters: Not applicable to date.

United States

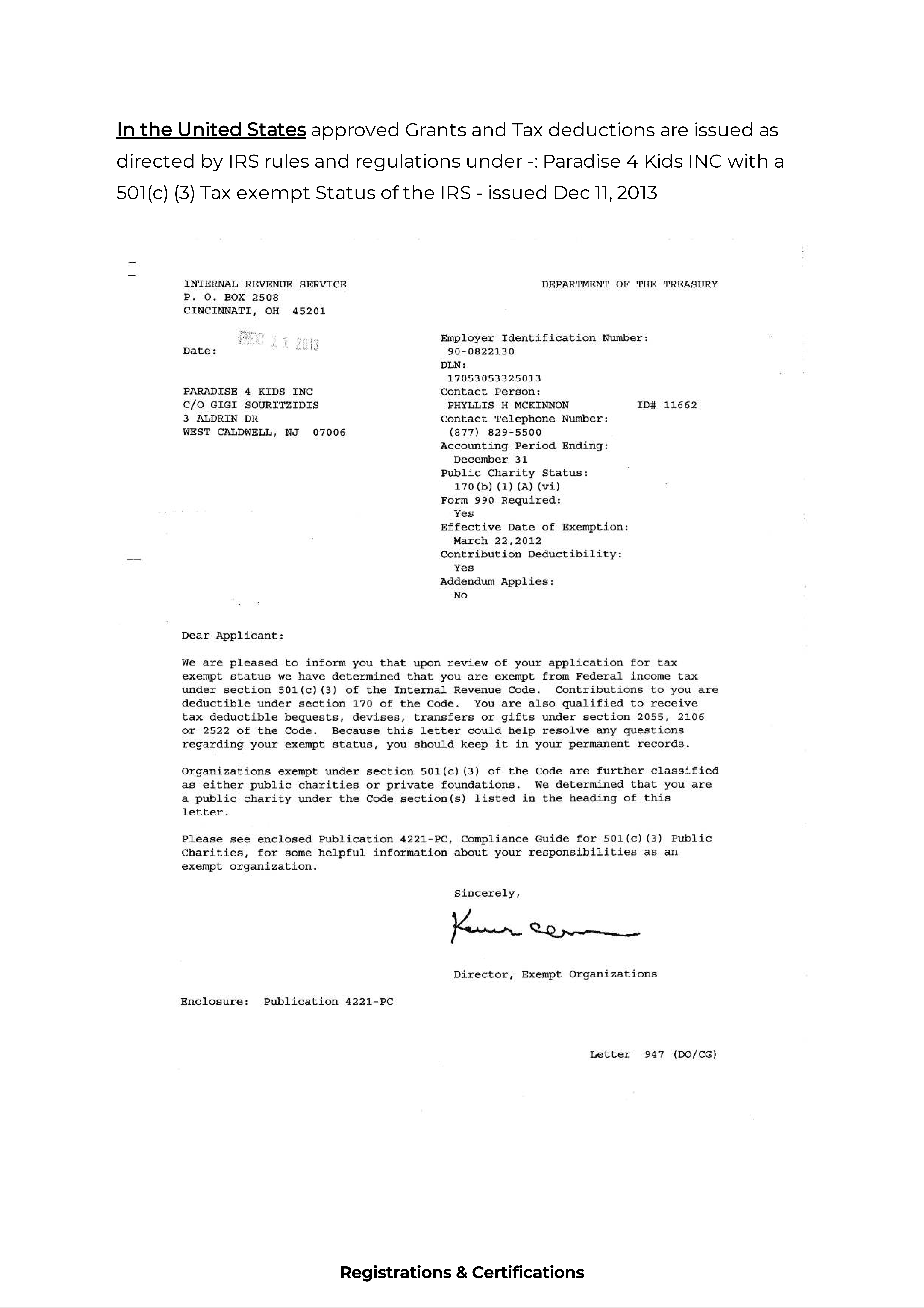

Paradise 4 Kids Inc has been recognized by the Internal Revenue Service as a Tax-Exempt Charitable Organization under Section 501(c)(3) of the Internal Revenue Code.

The Department of The Treasury acknowledged our status on Dec 11, 2013, effective from March 22, 2012.

Summary Audit letters: 2017 | 2018 | 2019 | 2020

Full Financials can be viewed on the IRS website.

Get in Touch. Get Involved.

If you would like to get in contact with us, please send a message via the email form below. Alternatively, click ‘Contact Details’ to see if we have a local contact in your country.